Crypto investment products had more inflows last week, continuing their upward trend. According to the latest CoinShares report, the total net inflows were $1.9 billion. This increased the month-to-date figure for July to a record-breaking $11.2 billion, which is more than the previous highest monthly flow of $7.6 billion that was set in December 2024 and Ethereum is leading the way in it.

Ethereum (ETH) was once again the most attractive asset, for the second consecutive week, with $1.59 billion of inflows – just its second-best week ever. As a result, Ethereum’s year-to-date (YTD) inflows have already reached $7.79 billion, which is more than the total of 2024.

Source: X

On the other hand, bitcoin-linked investment products were outflowed by $175 million. Nevertheless, BTC products still have the highest cumulative monthly and YTD inflows. The difference between price action and fund movement indicates the strategic behavior of investors.

Solana (SOL) and XRP pulled in $311 million and $189 million respectively, with altcoin investment still being concentrated. Sui also received modest gains, benefiting from $8 million inflows. Nonetheless, other altcoins such as Litecoin (LTC) and Bitcoin Cash (BCH) saw limited losses, which is the sign that investors’ selective appetite remains.

James Butterfill, the principal researcher at CoinShares, stated that the flow concentration by both asset and region is indicative of a tactical positioning in a market that is receptive to the ETF progress in the near term, rather than an entire altcoin season. He further added that, “These altcoin inflows may be a reflection of the U.S. ETF launches that are still upcoming rather than the state of broad-based enthusiasm.”

Regional Breakdown: U.S. Leads Inflows

The largest share of the influx, which amounted to $2 billion, came from the U.S., while Germany was in second place with $70 million. Outflows were registered in Hong Kong ($160 million), Canada ($84 million), and Brazil ($23 million), slightly dampening the overall positive picture.

This surge in the market is also consistent with the current developments of various ETF products. The dynamo behind Solana, XRP, and other altcoin ETFs has sped up, and the analysts from Bloomberg estimate the probability of the go-ahead being given to several funds in the very near future to be as high as 90%.

As institutional interest continues to rise, the crypto market appears to be entering a phase driven more by regulatory catalysts and targeted investment strategies than broad retail euphoria.

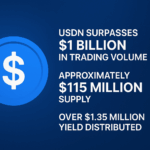

Also Read: USDN Stablecoin Surpasses $1 Billion in Trading Volume