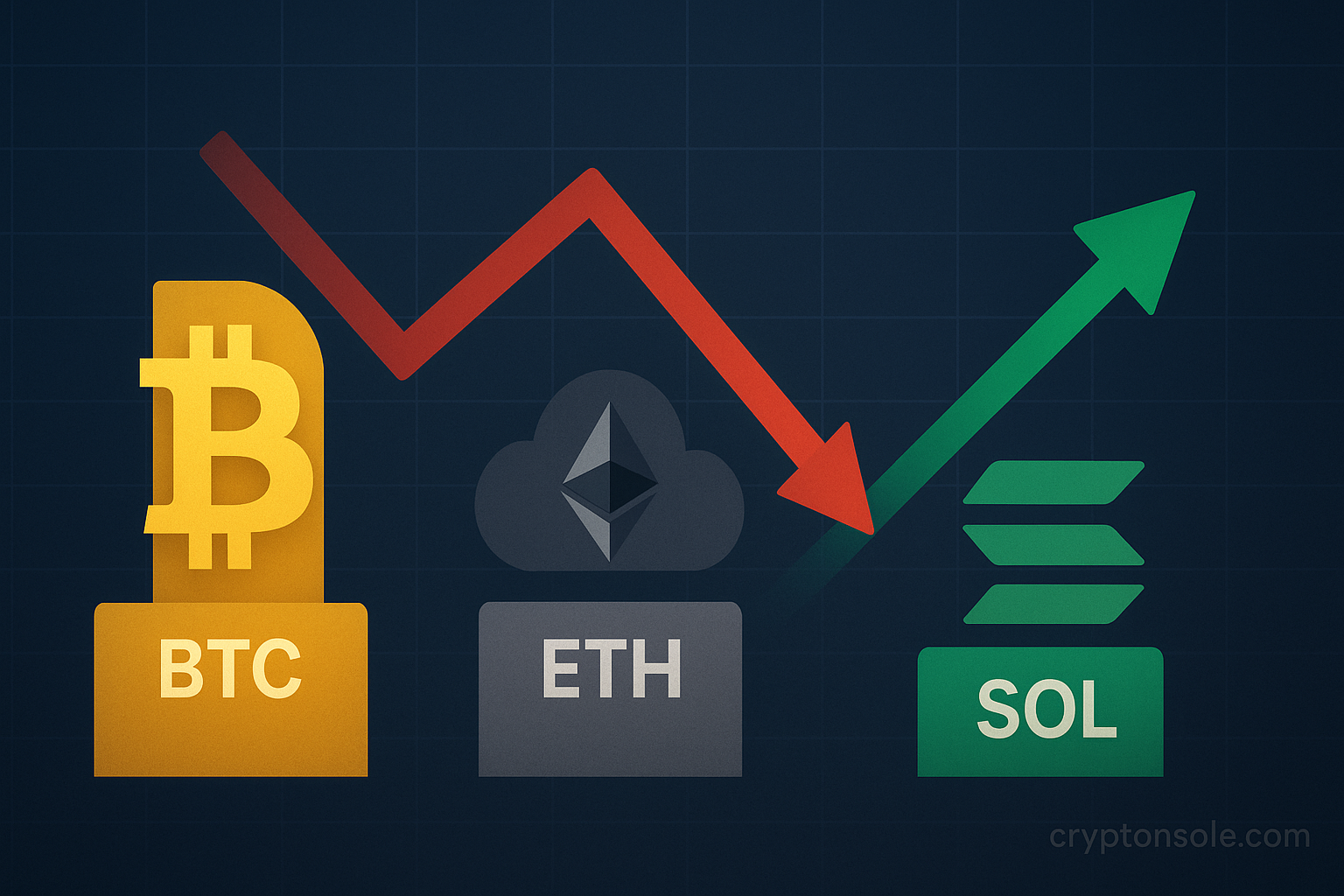

U.S. spot exchange-traded funds (ETFs) tied to Bitcoin (BTC) and Ethereum (ETH) experienced net outflows on Nov. 5, 2025, while Solana (SOL) spot ETFs continued to attract capital. According to flow trackers cited by market outlets, Bitcoin spot ETFs saw $137.0 million of net redemptions and Ethereum spot ETFs recorded $118.5 million in net outflows on Nov. 5 (Eastern Time). Solana spot ETFs, by contrast, posted $9.7 million of net inflows.

What the numbers show

- Bitcoin spot ETFs: $137,000,000 net outflow on Nov. 5.

- Ethereum spot ETFs: $118,500,000 net outflow on Nov. 5.

- Solana spot ETFs: $9,700,000 net inflow on Nov. 5.

Taken together, the BTC and ETH funds saw a combined net withdrawal of $255,500,000 on Nov. 5 (137,000,000 + 118,500,000 = 255,500,000). (Some market summaries round this to $256 million.)

Sources and methodology

Market news outlets reporting the flows cite data from ETF-flow analytics platforms such as SoSoValue and related aggregators; that dataset is what reporters used to compile the Nov. 5 flow totals. Where possible, exchanges and fund providers publish daily flow tables but industry trackers are typically the first to aggregate and distribute cross-fund totals used in this story.

Market context and reaction

- The outflows on Nov. 5 continue a streak of net redemptions for the major crypto spot ETF products in early November, as some investors rebalanced or took profits after strong October inflows into major crypto funds. Several outlets noted multi-day outflow runs for BTC and ETH funds through this period.

- SOL’s inflows stand out amid the broader redemptions, highlighting short-term rotation by investors into smaller-cap tokens and newer spot ETF products that have been receiving attention since regulatory approvals broadened the ETF slate. Some reports note that Solana ETFs have recorded several consecutive days of inflows in late October and early November.

Why it matters

ETF flows are watched as a near-real-time gauge of institutional and retail fund demand. Sustained outflows from BTC and ETH ETFs can put downward pressure on prices when they coincide with heavier sell programs, while inflows into alternative token ETFs can point to shifting investor interest or momentum trading. That said, daily ETF flows are one of many factors affecting crypto prices — macro conditions, derivatives positioning, and on-chain activity all also play roles.

Notable fund behavior (examples reported)

Industry coverage of the period highlights differences among specific funds (for example, some BlackRock or Fidelity products showing larger single-fund moves on particular days) — reporters typically break flows down by fund when that detail is available from the data provider. For the Nov. 5 totals above, the published aggregated figures reflect across-fund sums rather than single-product action.

Bottom line

On Nov. 5, 2025, BTC and ETH spot ETFs recorded significant single-day net outflows ($137.0M and $118.5M respectively), while SOL spot ETFs attracted $9.7M in inflows, underscoring short-term rotation within crypto ETF products. Investors should treat one-day flows as a data point within a broader picture that includes price action, macro drivers, and longer-term trends.

ZWVX0J0H