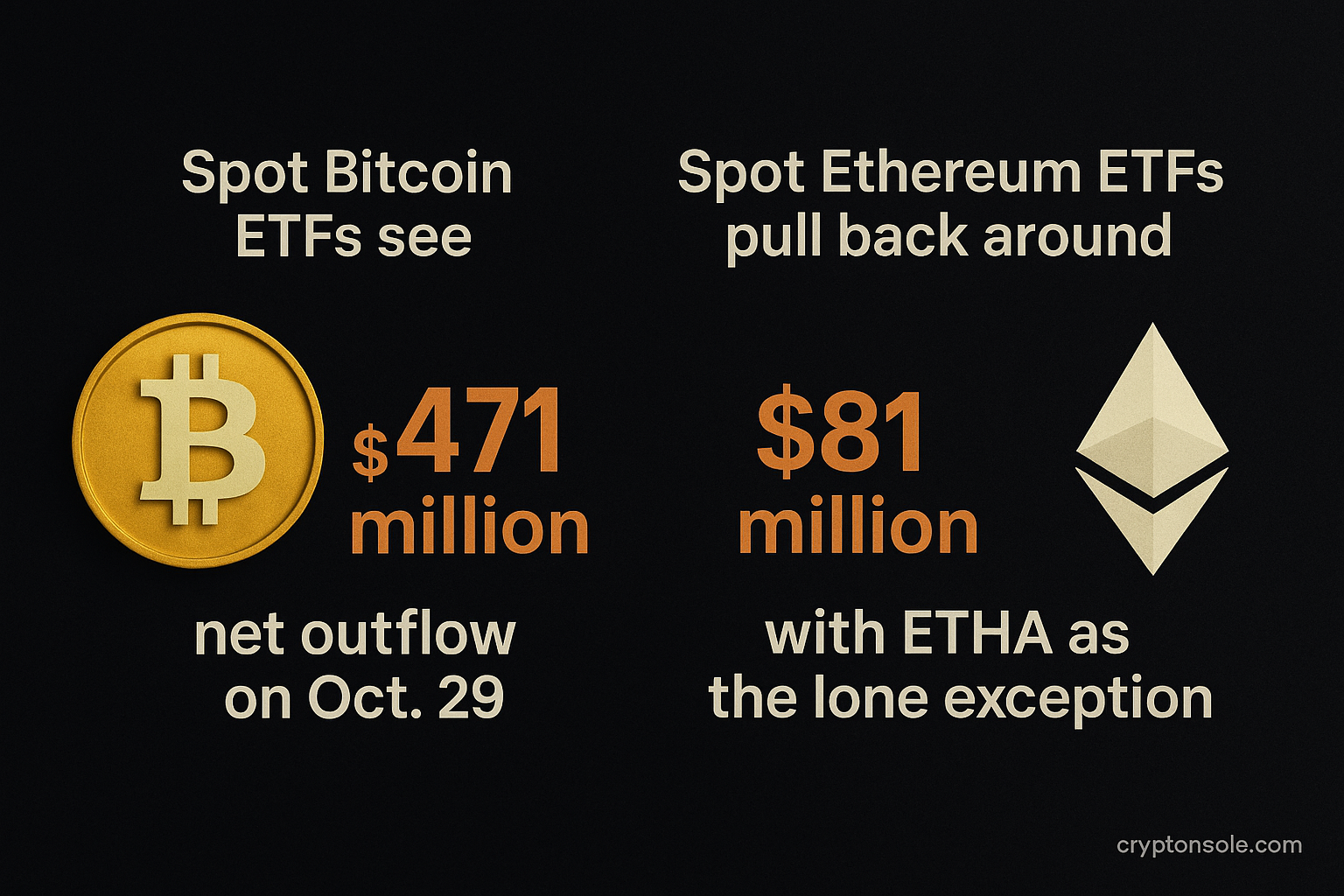

Spot Bitcoin ETFs see US$471 million net outflow on Oct. 29 — while spot Ethereum ETFs pull back around US$81 million, with ETHA as the lone exception

On Tuesday, Oct. 29 (ET), U.S. spot Bitcoin exchange-traded funds (ETFs) registered a combined net outflow of approximately US$471 million, with none of the 12 funds reporting a net inflow. At the same time, spot Ethereum ETFs posted a collective net outflow of around US$81 million, though ETHA (from BlackRock) was the only fund to record a net inflow. These flows signal a moment of caution in crypto-ETF markets just as broader institutional interest is under scrutiny.

What the data shows

- According to data compiled by SoSoValue and reported0 via Odaily, all twelve U.S. spot Bitcoin ETFs posted net redemptions totalling about US$471 million on Oct. 29.

- For Ethereum spot ETFs, multiple sources report net outflows of US$81 million (or similar figure) for the day; while exact fund-by-fund breakdowns were not publicly reconciled in all datasets, the highlighted fact is that ETHA posted a net inflow. (Several related flow-tracking outlets cite similar numbers for ETH ETFs)

- The Bitcoin outflows mark one of the larger single-day redemptions in recent weeks, at a time when these products had seen periods of inflows in earlier sessions.

Why this matters

- Liquidity & supply pressure: Large outflows from Bitcoin spot ETFs can imply that market makers and fund issuers are redeeming large blocks of Bitcoin, which may increase the available float on spot exchanges, reduce scarcity, and put downward4 pressure on prices if demand doesn’t pick up.

- Institutional sentiment shift: The outflows suggest a temporary pull-back in institutional appetite for crypto-spot ETFs, or at least selective risk management among institutional investors.

- Differential between BTC and ETH products: That ETHA was the lone spot-ETH-ETF fund to record net inflows highlights differentiation among issuers – investors appear to favour certain brands or structures even amid broad redemptions.

- Timing in cycle: These flow moves come at a time when macro-conditions (interest-rate uncertainty, regulatory developments, inflation data) are unsettled, making crypto-flows more sensitive to sentiment2 and fund-behaviour than in calmer periods.

Risks & considerations

- One-day snapshot: While this day’s flows are meaningful, one day’s redemptions don’t necessarily define a trend. Inflows in prior days and weeks may counterbalance the outflow.

- Source transparency: Flow-tracking relies on publicly available ETF disclosures and on-chain/custody data; some delays or data-lags may affect accuracy.

- Underlying market vs ETF demand: The ETF flows reflect investor behaviour via regulated vehicles; they may not capture all spot market0 dynamics (OTC trades, self-custody flows, derivatives).

- Fund-specific factors: Outflows may relate to fund-specific issues (tax-year window, rebalancing, creation/redemption mechanics) not purely market-sentiment.

- Macro & regulatory risk: The crypto-market is strongly influenced by macro shifts, regulatory news and sentiment; large flows may reflect these external factors as much as pure demand for the underlying asset.

What to watch next

- Next-day flows & trend persistence: See whether outflows persist, reverse, or alternate with inflows over coming sessions; recurring redemptions would signal a material shift.

- Issuer-specific disclosures: Check for commentary from major ETF issuers (e.g., BlackRock, Fidelity, ARK) about redemption pressure, creation activity or changes in AUM.

- Spot market price action: Observe how Bitcoin and Ethereum spot prices respond in the 24-48 hours after large ETF outflows; whether price drops deepen or recover could indicate whether outflows are driven by liquidation or rotation.

- Macro/regulatory headwinds: Monitor interest-rate announcements, SEC/regulator statements on crypto-ETFs and institutional investor commentary that may drive next-step flows.

- ETH ETF differentiation: The fact that ETHA bucked the outflow trend means investigating what product features, brand trust or structure may be attracting investor flows — this might gauge future fund-differentiation.

Bottom line

The US$471 million outflow from Bitcoin spot ETFs and the US$81 million outflow from Ethereum spot ETFs on Oct. 29 represent a notable retreat of institutional and fund-channelled capital on that day. While not necessarily a long-term reversal, the data reinforces that crypto-flows remain sensitive to macro and sentiment swings and that ETF-demand is not immune to redemptions. For investors and market watchers, the event underscores the importance of monitoring fund flows as part of the larger crypto market-structure picture.

3W8EEU3Q