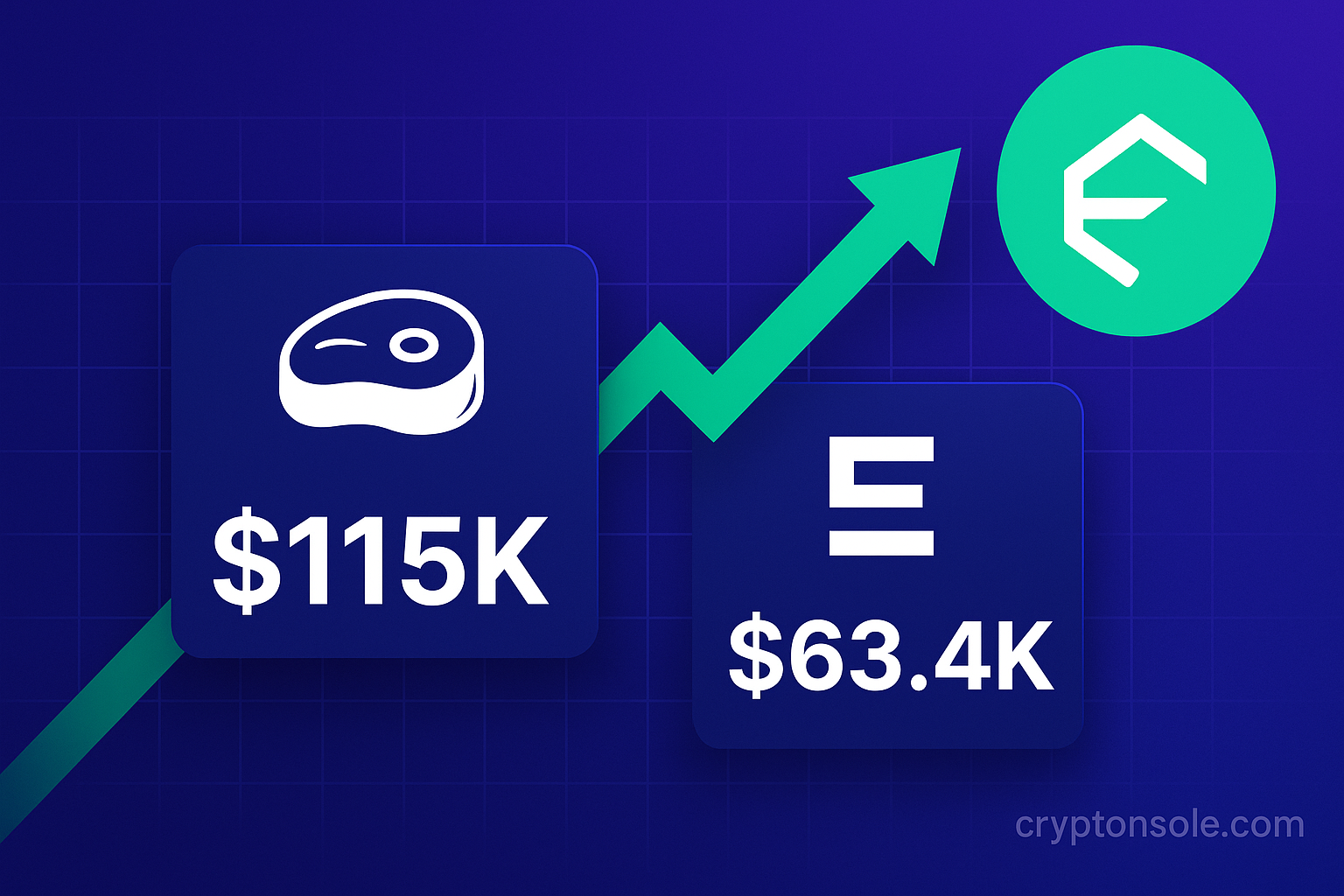

Morpho’s on-chain curator marketplace posted a banner week of performance fees the week of November 3–9, 2025, with the protocol’s public dashboards and analytics showing total curator fees reached a new weekly high — north of $370,000. Steakhouse Financial was the top earner, taking roughly $115,000 in curator fees, while MEV Capital ranked third with about $63,400 — but the latter then reported its first recorded curator loss this week, exceeding $65,000, underscoring both the upside and the risks of permissionless curator strategies.

Lede: record week and a stark reminder of risk

Morpho’s vault model — which lets independent “curators” design yield strategies for depositors and collect performance fees — generated exceptional fee income last week as capital rotated between vaults and markets. The official Morpho curator pages and community analytics dashboards show the jump in aggregate curator fees and confirm Steakhouse Financial’s top position among curators by fee capture. At the same time, community posts and vault updates indicate MEV Capital’s USDC vault suffered an on-chain loss this week that pushed the manager into negative territory after earlier gains.

How curator economics work

Morpho’s Vaults V1/V2 fee design charges curators a performance fee (plus optional management fees in V2) on the interest their strategies generate; fees are typically minted as shares to fee recipients when interest accrues. That fee architecture concentrates reward for successful strategies but also aligns curator incentives with yield-seeking behavior that can carry counterparty or liquidation risks in stressed markets. The protocol’s documentation lays out the mechanics that turned last week’s high yields into meaningful revenue for active curators.

The winners

Steakhouse Financial — which has grown into one of Morpho’s largest curators across multiple chains — led the fee leaderboard for Nov. 3–9, capturing roughly $115,000 in performance fees for its curated vaults. Steakhouse’s public profile and Morpho feature stories have highlighted the firm’s strategy of running diversified vaults across Ethereum, Base, Polygon and other chains, a positioning that helped it capture outsized fee flows during a week of active reallocations.

The losers — and why losses can happen

MEV Capital, a prominent on-chain liquidity manager and curator, had been among the top earners but posted its first significant curator loss this week — community posts and the vault’s Morpho page show share-price declines and user reports of negative returns totaling in excess of $65,000 across affected deposits. The loss appears tied to adverse allocation moves and market stress across underlying lending markets; the episode illustrates how high-yield curator strategies on permissionless rails can flip from profitable to loss-making quickly when liquidity or price dynamics shift. MEV Capital’s own site and the vault page record operational details and status updates for affected vaults.

Broader context: why curator fees spiked

Analysts and industry writeups point to a short period of capital rotation and elevated borrowing rates on several lending venues that curators take advantage of to juice yield. When borrow rates rise, vault interest accruals — and therefore curator performance fees — increase, producing the weekly spikes seen on dashboards like Morpho’s and community analytics (Dune / Block explorers) that track curation revenue. At the same time, the sector faces heightened scrutiny: commentators have warned that a yield arms race among curators can encourage risk-taking that leaves depositors exposed if markets unwind.

Reactions from the community and protocol operators

- Morpho dashboards & analytics: public pages and third-party dashboards reflected the record weekly fees and the distribution among curators; these dashboards remain the primary source for near-real-time curator fee tallies.

- Curator communications: Steakhouse’s public materials highlight growth and multi-chain exposure as drivers of fee capture; MEV Capital and affected depositors have posted updates in Morpho forums and the vault’s status page as they investigate the loss and any mitigation steps.

- Industry commentary: analysts note the episode is emblematic of the trade-off in permissionless DeFi between attractive, protocol-native yield and tail-risk from integrations with leveraged or fragile credit markets.

What to watch next

- Vault share prices and TVL — whether MEV Capital’s loss prompts outflows or re-allocations across vaults.

- Fee trends on Morpho dashboards — if elevated borrowing rates persist, curator fee income could remain high, but volatility raises the chance of reversals.

- Protocol risk disclosures and timelocks — any fee or parameter changes by curators or owners that are timelocked onchain will be important signals for depositors.

Bottom line

Last week’s record curator fees on Morpho demonstrated the economic power of permissionless curation: when markets move in favor of active strategies, curators can extract significant revenue. But the MEV Capital loss the following week is a timely reminder that yield and risk remain inextricably linked on DeFi rails — and that depositors and curators alike must weigh the upside of performance fees against the possibility of rapid losses when market conditions change.

6PF9HEQ3