Key Takeaways

- Gryphon Digital Mining shareholders approve merger with American Bitcoin.

- The firm will implement a 5-for-1 reverse stock split to meet Nasdaq listing rules.

- Trump family ties to the venture raise its profile in U.S. crypto markets.

Gryphon Shareholders Approve American Bitcoin Merger

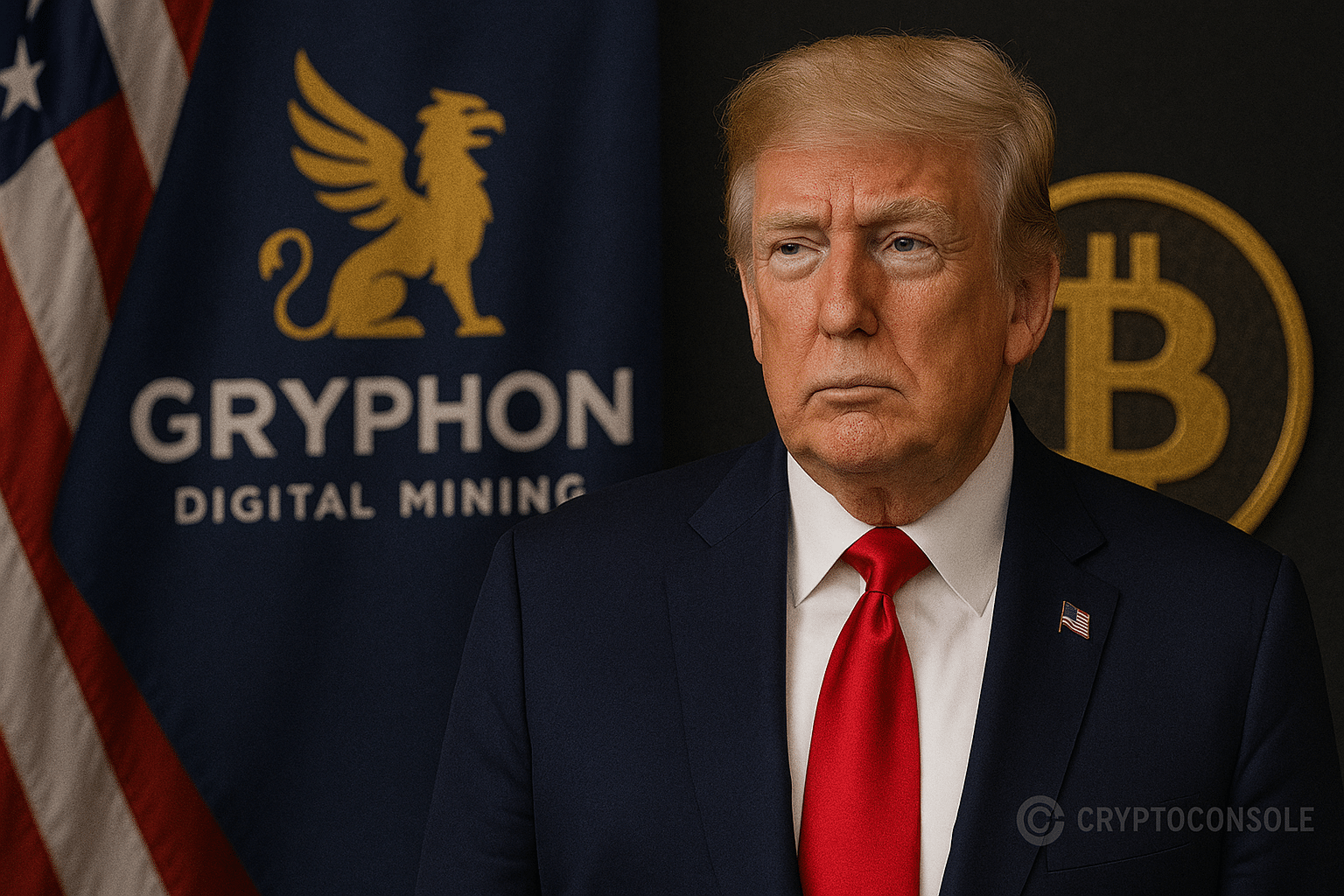

Gryphon Digital Mining (ticker: GRYP) shareholders have given the green light to the planned merger of the company with American Bitcoin, a newly established crypto mining firm linked to the Trump family.

The deal that was made public earlier this year comprises a stock-for-stock transaction that will unite Gryphon with a subsidiary of publicly traded miner Hut 8.

The Friday announcement reported that, earlier in the week, Gryphon shareholders voted in favor of the merger during a meeting. After the vote, the company also announced that to comply with Nasdaq’s minimum bid price requirements, it intends to carry out a reverse stock split at a 5-for-1 ratio.

The combined company will use the symbol ABTC on the Nasdaq exchange, which is consistent with its branding as American Bitcoin. The stock split is expected to become effective, on Tuesday, September 2, right after the Labor Day holiday in the U.S.

Reverse Stock Split and Nasdaq Requirements

The reverse stock split is a move designed to bring Gryphon’s outstanding shares down to a level that meets Nasdaq’s listing standards. Although the number of shares in circulation decreases with this adjustment, the company states that there will be no changes in the rights of shareholders and the total market capitalization.

Gryphon is set to use the proceeds of this share consolidation and its relisting under the American Bitcoin moniker to not only stabilize its market presence but also to attract the interest of both institutional and retail investors. Moreover, the revamped listing symbolizes the enlarged goals of the merged entity as it aims to be a leading U.S.-based Bitcoin mining operator with the help of connections to powerful people.

Trump Family Connections to American Bitcoin

One of the prominent elements highlighting the merger is the link with the Trump family. Both Eric Trump and Donald Trump Jr. have shareholding interests in American Data Centers that is the parent company of American Bitcoin with a 20% stake. Hut 8, one of the biggest publicly funded crypto mining firms, will have a 80% controlling power over the new company formed by the combination of the two.

Eric Trump has stepped into the shoes of chief strategy officer, signaling that the Trump family plays a fundamental part in steering the company’s way. In light of this, American Bitcoin has revealed ambitious plans to become a leading Bitcoin holder through mining operations Zachary.

The company is already halfway through its $220 million goal, which it made through a private placement, using the proceeds both to acquire Bitcoin and for the purchase of mining assets. Capital that will allow for the breakthrough of bold strategies by American Bitcoin in the increasingly competitive landscape of domestic mining will be the starting point for them.

Market Performance and Strategic Outlook

Gryphon’s stock (GRYP) dramatically dropped by 11.56% on Friday despite shareholder approval of the merger. Meanwhile, Hut 8 (HUT) shares closed with a slight increase of 0.53% which pointed to the lukewarm market reception of the deal.

Commentators note that the market fluctuation results to a great extent from both anticipation of the new venture’s success and doubts concerning its political ties. American Bitcoin hopes to end up creating a poster child for America-based environmentally friendly Bitcoin mining by combining Gryphon’s operations with Hut 8’s tried and tested infrastructure and the backing of the Trump family.

By concentrating on gathering a Bitcoin reserve for strategic purposes, the company is following the line of a widespread inclination in the crypto sector that firms after short selling and mining BTC rather than simply holding them as long-term assets. Such a move is similar to the ones used in other crypto companies and could potentially make American Bitcoin more stable in case of market crashes.

Summary

The approval of the merger between Gryphon Digital Mining and American Bitcoin marks a significant milestone in U.S. crypto mining. With shareholders voting in favor of the stock-for-stock transaction, Gryphon will implement a 5-for-1 reverse stock split and re-list under the ticker ABTC on the Nasdaq exchange.

Backed by Hut 8’s 80% stake and the Trump family’s 20% ownership through American Data Centers, the newly formed American Bitcoin is positioned to become a high-profile player in the mining sector. With $220 million raised for mining expansion and reserve accumulation, the venture aims to establish itself as a leading force in the industry.

While investor reactions remain mixed, the merger underscores the growing intersection of politics, finance, and cryptocurrency. As American Bitcoin begins operations under its new banner, it enters the market with both significant resources and considerable public attention.

Also Read: Eclipse Labs Shock: Cuts 65% Staff and Names Powerful New CEO

M78MYWY6