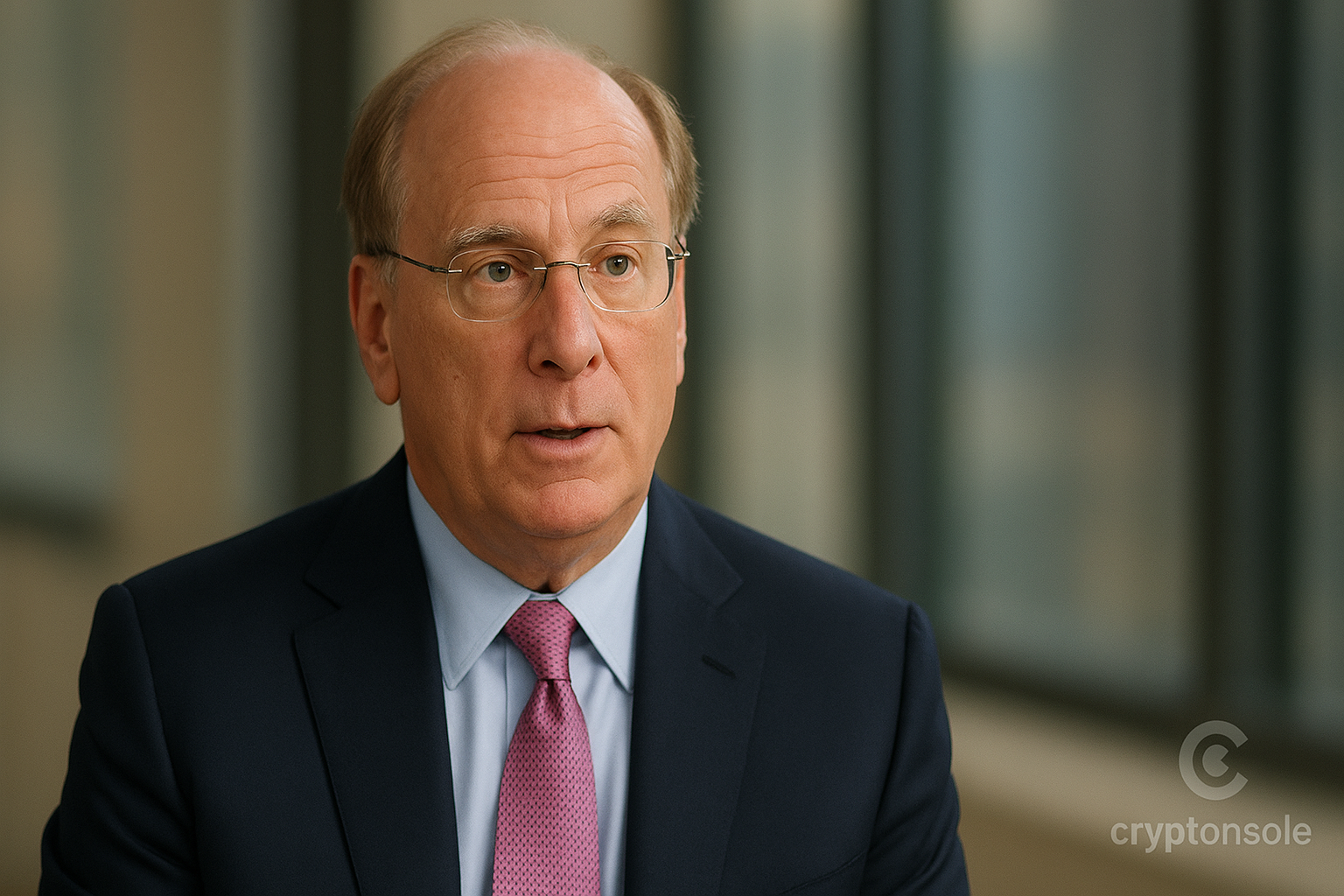

BlackRock CEO Larry Fink said in a 60 Minutes interview that cryptocurrency has a place in modern portfolios “in the same way there is a role for gold,” calling it an “alternative” that can help diversify holdings — while warning it should not be a large component of most investors’ portfolios.

Key takeaways

- Larry Fink told 60 Minutes that crypto can play a role similar to gold as an alternative asset, but cautioned against overweighting it.

- BlackRock — the world’s largest asset manager — has pushed into crypto markets (notably with its iShares Bitcoin Trust) while managing roughly $12.5 trillion in assets.

- Fink’s comments mark a further shift from earlier skepticism and reinforce a broader trend of mainstream asset managers offering regulated, institutional-grade exposure to Bitcoin and related products.

‘Digital gold’ — a deliberate comparison

In a wide-ranging 60 Minutes conversation with Lesley Stahl and Andrew Ross Sorkin that aired Oct. 12, 2025, Fink acknowledged his earlier skepticism about Bitcoin but said his views have evolved. “There is a role for crypto in the same way there is a role for gold, that is — it’s an alternative,” he told the program, adding that the asset class can serve investors seeking diversification but “should not be a large component of your portfolio.”

Why the timing matters

BlackRock’s interest in crypto is now concrete: its iShares Bitcoin Trust (IBIT) has become one of the fastest-growing ETFs since launch, drawing substantial assets and institutional attention. The rapid accumulation of Bitcoin into regulated ETFs has played a central role in legitimizing Bitcoin for some long-term investors and large managers.

BlackRock itself reported record assets under management of about $12.5 trillion in mid-2025, underscoring how the world’s largest asset manager could influence mainstream investor access to crypto products.

From skeptic to cautious proponent

Fink’s evolution mirrors a broader industry shift. In earlier years he voiced skepticism, calling Bitcoin (at the time) associated with illicit activity — a position he has publicly revisited. Over the last few years major asset managers have moved to offer regulated vehicles designed to give ordinary investors exposure to crypto without direct custody risks. Fink’s 60 Minutes comments reinforce that approach: accept crypto’s potential role, but emphasize risk controls and proportionate allocation.

What this means for investors and markets

Analysts say comments from prominent CEOs like Fink can heighten investor confidence in regulated crypto products, possibly driving more inflows to ETFs and funds that provide indirect7 exposure. But market watchers and regulators continue to flag volatility, oversight gaps, and the need for investor education — factors Fink himself acknowledged when urging caution.

Bottom line

Larry Fink’s 60 Minutes remarks cement a pragmatic industry stance: cryptocurrencies, particularly Bitcoin, are increasingly treated as an investable alternative similar to gold — useful for diversification but not a core holding for most investors. His comments are likely to be viewed as an endorsement of regulated, institutional crypto products while reaffirming the need for measured allocations and vigilance.

1FRYDIB9