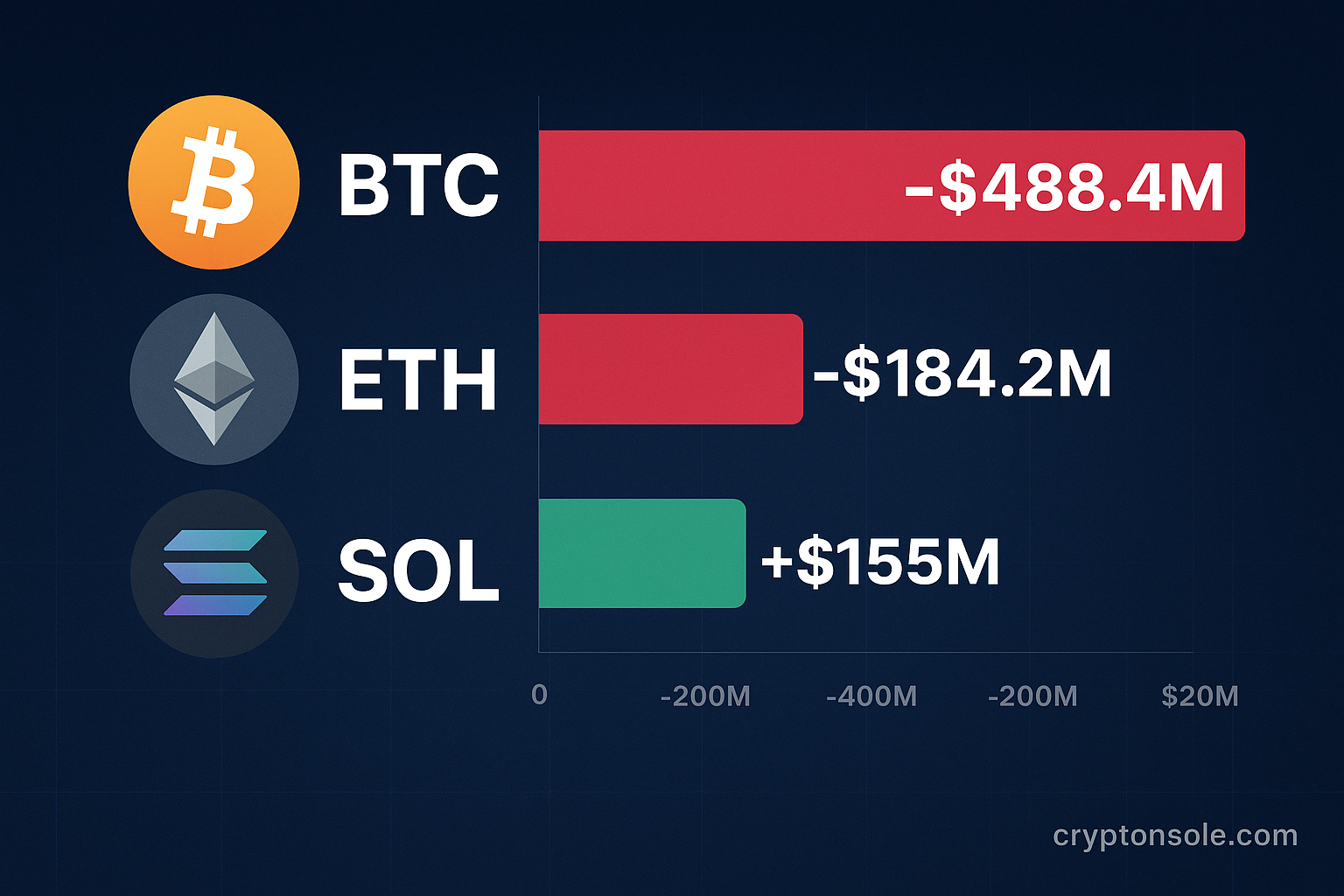

On Oct. 30 (ET), U.S. spot Bitcoin ETFs reported a combined net outflow of approximately US$488.4 million, while spot Ethereum ETFs faced about US$184.2 million in net redemptions. In contrast, spot Solana (SOL) ETFs enjoyed roughly US$155 million in inflows, providing a rare bright spot amid broader crypto-ETF outflows.

Flow details

- According to data from SoSoValue and other tracking platforms, spot Bitcoin ETFs recorded net outflows of around US$488 million on Oct. 30.

- Spot Ethereum ETFs posted net outflows of about US$184 million that day, with some issuer-level data indicating major redemptions.

- At the same time, spot Solana ETFs saw meaningful inflows (~US$155 million) as investors rotated capital to altcoin-exposure vehicles.

- These disparate flows highlight diverging investor sentiment across crypto-asset ETF categories, even as underlying prices for the assets remained under pressure.

Why it matters

- Liquidity and supply effects: Large outflows from Bitcoin and Ethereum ETFs can increase liquid supply of those assets on the open market (if ETF creation/redemption mechanisms unwind), potentially placing downward pressure on prices.

- Sentiment shift in institutional channels: The heavy redemptions suggest institutional and retail participants may be reducing exposure to major crypto-asset ETFs, possibly due to macro concerns, profit-taking or risk-off positioning.

- Altcoin and infrastructure rotation: Solana’s inflows indicate some investors are seeking differentiated exposure within the crypto ecosystem — perhaps betting on layer-1 infrastructure narratives or higher-beta assets.

- Timing and market context: The flows coincide with broader crypto-market pullback amid interest-rate uncertainty, weaker risk appetite and waning momentum, underscoring that ETF flows remain sensitive to macro drivers.

Risks and caveats

- One-day snapshot: While the Oct. 30 flows are large, one day does not necessarily mark a trend; flows from adjacent days may offset or continue the pattern.

- Data-source timing: ETF-flow reporting can lag and timing of creation/redemption disclosures may vary, so figures should be taken as indicative rather than final.

- Underlying vs fund flows: ETF flows reflect fund-channel movement; they do not necessarily capture OTC trades, self-custody movements or derivatives flows, which also influence the market.

- Price and yield interactions: Withdrawals may reflect price weakness (investors exiting) or liquidation risk rather than pure sentiment; similarly, inflows into Solana may reflect speculative positioning rather than stable conviction.

What to watch next

- Flow confirmation and trend persistence: Monitor subsequent daily net-flow data for Bitcoin, Ethereum and Solana ETFs to see whether the outflow/inflow patterns persist or reverse.

- Issuers’ commentary: ETF sponsors (e.g., BlackRock, Bitwise) may issue commentary about creation/redemption pressures, AUM trends or structural changes that explain large flows.

- Spot-asset price response: How Bitcoin, Ethereum and Solana spot prices react in the 24–48 hours after these flows may signal whether the flows are precursors to deeper market moves.

- Macro/regulatory triggers: With interest-rate announcements, regulatory updates and global risk-events looming, watch whether macro triggers are causing fund-flow shifts.

- Altcoin ETF growth and differentiation: The Solana ETF inflows could mark the beginning of broader interest in altcoin-infrastructure ETFs; tracking whether this pattern spreads to other assets will be informative.

Bottom line

The US$488 million outflow from spot Bitcoin ETFs and US$184 million redemption from spot Ethereum ETFs on Oct. 30 underscore a marked pause in institutional-channel crypto demand — even as Solana ETFs captured a rare tranche of positive flows. While this snapshot does not define the entire market cycle, it highlights the sensitivity of crypto-ETFs to macro-flows and rotation, and signals that investors may now be looking beyond the major two assets toward differentiated bets in the ecosystem.

DRT9JK52