Softer U.S. labor data has pushed Wall Street to price in September rate cuts from the Federal Reserve, yet crypto markets remain largely range-bound. Options-desk commentary from QCP Capital says short-dated implied volatilities have ticked higher and demand for September puts is rising ahead of this week’s U.S. CPI print—keeping the base case as continued consolidation unless a clear catalyst8 emerges.

Key points

- Macro backdrop: August nonfarm payrolls rose just 22,000 and unemployment climbed to 4.3%, firming expectations for a Fed cut on Sept. 17 (some desks now see scope for 50 bps). CPI lands this week.

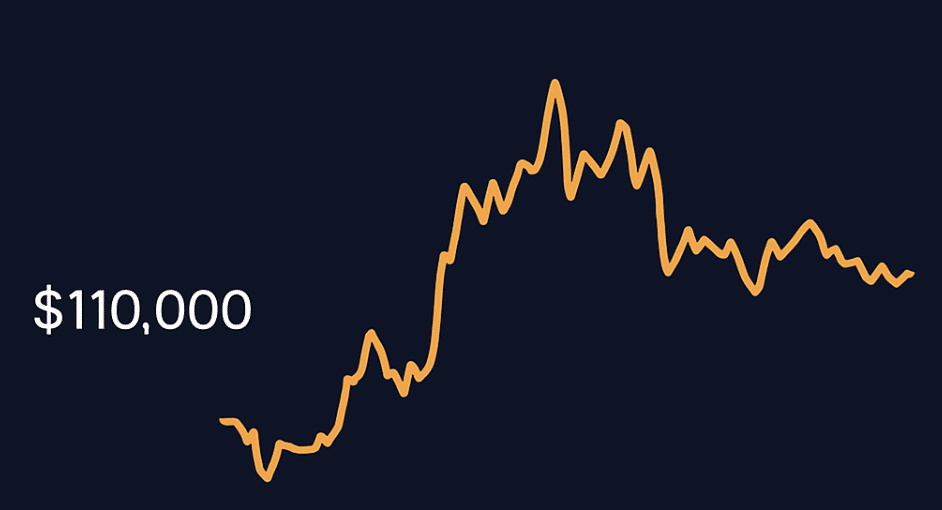

- Market tone: BTC holds above $110K and ETH above $4,250 as of ~5:16 p.m. IST, with price action muted despite macro shifts.

- Derivatives: QCP highlights front-end IV firming and increased demand for near-term (September) puts as traders hedge CPI risk.

- Flows: Spot Ether ETFs saw sustained outflows (≈$952M over five days). U.S. Bitcoin ETFs posted a $160Mdaily outflow on Sept. 5, underscoring mixedz fund flows.

Market snapshot (IST)

- Bitcoin (BTC): $111,833, little changed intraday, after a choppy post-jobs reaction.

- Ether (ETH): $4,304, steady above the $4.25K handle.

What QCP and desks are watching

QCP’s recent notes flag a cautious hedge-building into CPI: short-dated BTC puts around the $115K–$118K area drew interest last month, and today’s options color points to renewed front-end demand with risk-reversal skews reflecting downside protection bids. That pattern is consistent6 with implied vol ticking up into macro events.

Why prices are holding up

Even as rate-cut odds climb on weaker jobs, risk appetite is capped by ETF outflow headlines—especially in ETH—plus the near-term event risk from CPI. Analysts also note that BTC’s resilience above $110K suggests range tradingwhile traders wait for a clearer signal from inflation and the Fed path.

Outlook

Unless CPI meaningfully surprises, QCP expects sideways trade with elevated front-end vol and put demand persisting into mid-September. A softer-than-feared print could compress vol and nudge BTC to re-test topside levels; a hot print would likely validate the hedges and extend consolidation/lower.

AM0FIMY4