Key Takeaways

- Do Kwon admits guilt in U.S. federal court to fraud charges.

- Collapse of TerraUSD and Luna caused $40B investor losses.

- Faces a possible sentence of up to 25 years in prison.

Do Kwon Accepts Responsibility for Frauds Case in the U.S.

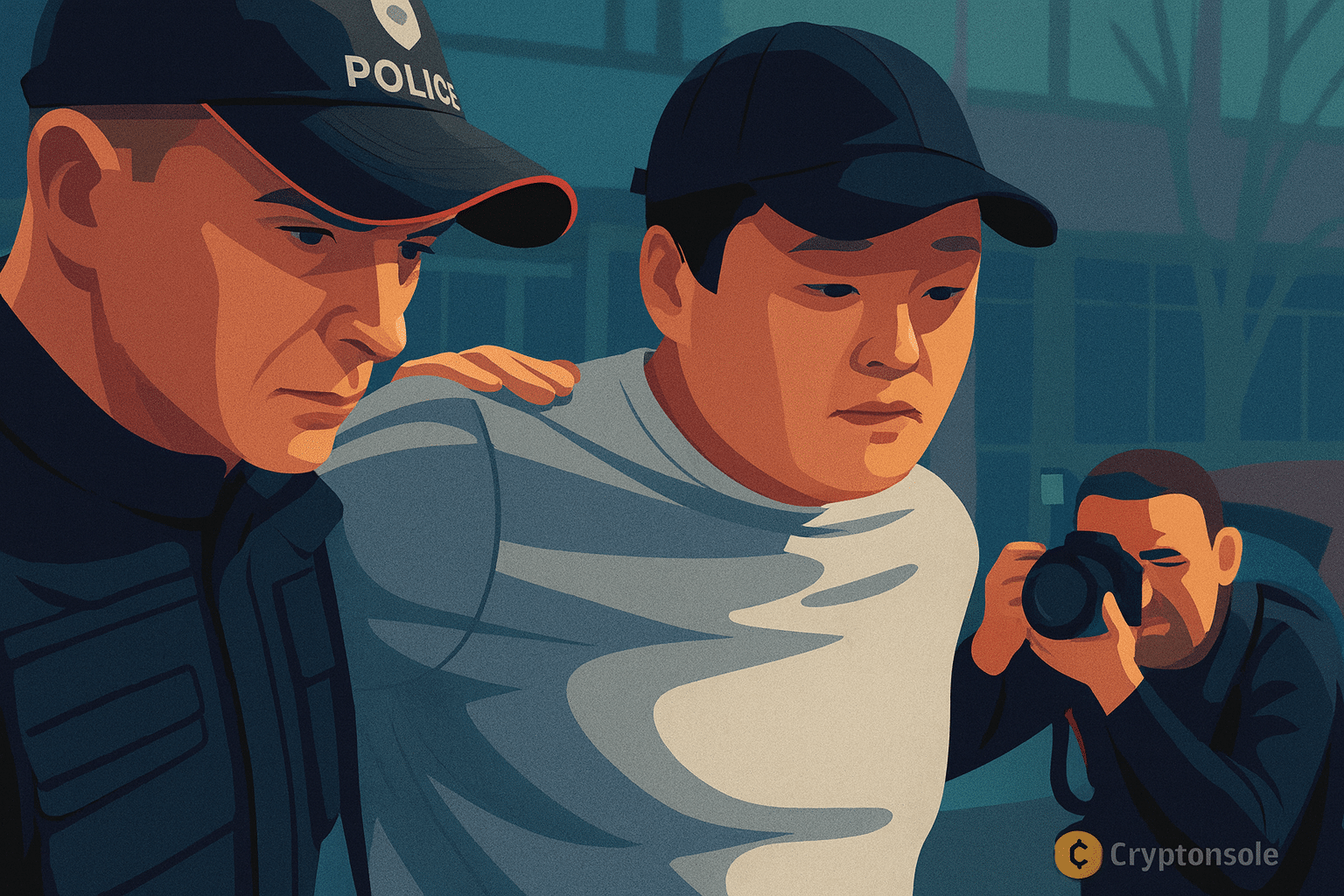

Following Do Kwon’s announcement9 and reporting by Reuters, the Terraform Labs CEO said in the U.S. court on Tuesday that he was responsible for two federal offenses: conspiracy to defraud and wire fraud. Those charges consist of the drama that surrounded the collapse of the firm’s cryptocurrencies TerraUSD and Luna, which led to one of the most significant falls of the digital asset market history.

District attorneys have presented evidence showing that Kwon concealed the development and safety of TerraUSD. The project was aimed to be a self-explanatory stablecoin set up through giving it an unchangeable value. When in May 2022, it had collapsed, the market value of the whole crypto sector has been reduced9 by roughly $40 bn, a domino effect of bankruptcies, and liquidity shortages has been activated.

Maybe a Quarter of a Century in Jail

If found guilty, Do Kwon might be sentenced7 to serve a sum of time not exceeding 25 years in a federal prison. This is a very severe case, which is reflected in the way the allegations show the possibility of global financial market disruptions. The submission of the guilty plea is an important step in the confrontation of crypto executives by the US authorities that is happening now over the issue of investor deception.

After a marathon escape, Kwon was captured last year and has since been among those seeking justice in different courts. This particular U.S. lawsuit is the heaviest because of the exact scale and the number of victims, who are the investors residing in different countries.

Legal analysts say the outcome could set a precedent for how regulatory and judicial systems handle large-scale crypto fraud cases in the future, potentially reshaping compliance standards for the industry.

Summary

Do Kwon’s guilty plea to federal fraud charges in the U.S. brings a major chapter in the TerraUSD and Luna collapse closer to conclusion. With $40 billion in losses and a possible 25-year sentence, the case stands as a stark reminder of the high stakes in cryptocurrency markets and the growing resolve of regulators to ensure accountability.

Also Read: Upbit Lists CYBER With KRW and USDT Trading Pairs

QX2QNWCE