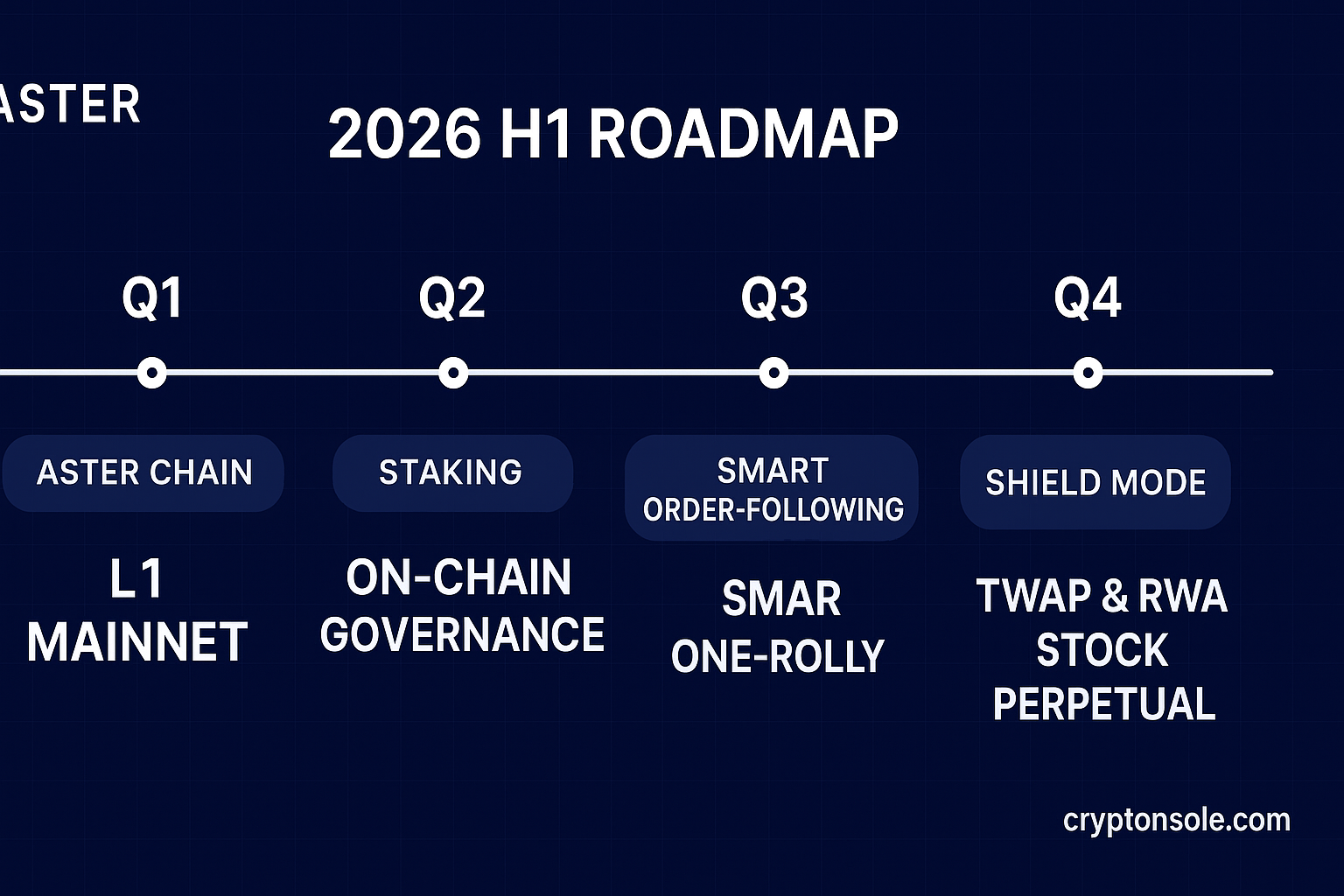

Aster — the project born from the merger of Astherus and ApolloX — has published its roadmap for the first half of 2026. The highlight: the planned launch of the Aster Chain mainnet (L1) in Q1, followed by staking, on-chain governance, and smart order-following tools in Q2. The roadmap also details upcoming December 2025 milestones including testnet rollout for “Shield Mode,” TWAP strategies, and upgrades to its RWA stock perpetual system.

What the roadmap includes

- Q1 2026 — Aster Chain L1 mainnet: Aster plans to launch its privacy-focused Layer 1 blockchain in the first quarter of 2026. The chain is designed for high-performance on-chain order-book trading with optional privacy features, combining speed with confidentiality for traders.

- Q2 2026 — $ASTER staking and governance: With mainnet live, Aster will activate token staking (for validators and delegators) and enable on-chain governance, granting token-holders say over protocol parameters.

- Q2 — Smart order-following tools: The roadmap includes advanced trading tools that will let users set automated or “follow-order” strategies — part of Aster’s effort to mimic CEX-level functionality while staying decentralized.

- Late 2025 / December — Testnet & feature upgrades: In December 2025, Aster aims to roll out a testnet that supports “Shield Mode,” TWAP (time-weighted average price) strategies, and enhanced real-world-asset (RWA) stock perpetual mechanisms.

Background: Where Aster stands today

The present-day Aster emerged from a merger of Astherus and ApolloX — a rebrand that combined their skill sets to build a platform blending CEX-style execution with DeFi/self-custody principles.

Since the merger and token-generation event (TGE), Aster has already rolled out several features: derivatives trading, commodity and perpetual contracts, and early utility for the $ASTER token including fee discounts, VIP tiers, and airdrop eligibility.

Recent tokenomics changes further delayed planned 2025 unlocks to 2026 and 2035 — a move meant to reduce short-term supply pressure and reinforce long-term alignment.

Why this roadmap matters

- A true L1 + DEX hybrid: By building its own L1 blockchain for order-book trading (rather than relying on existing blockchains), Aster aims to combine the speed and UX of centralized exchanges with the transparency and self-custody benefits of DeFi.

- Token utility & governance: Staking, governance, and on-chain participation may strengthen $ASTER’s role beyond just speculative trading — potentially increasing demand for the token.

- Institutional appeal & privacy: With optional privacy and high throughput, Aster may attract more professional traders and institutions that value execution security and signal confidentiality.

- De-risked supply release: Delaying token unlocks helps mitigate immediate sell pressure, making the upcoming milestones more meaningful for long-term holders.

Risks & What to Watch

- Execution risk: As with any roadmap, meeting all deadlines — especially a mainnet launch and staking/governance launch — will require rigorous development and auditing.

- Competition: The DEX / crypto derivatives space is crowded; Aster’s success will depend on liquidity, user adoption, and how effectively it differentiates from rivals.

- Market sentiment: Token price and utility may be volatile; roadmap optimism doesn’t guarantee market support or sustainable volumes.

- Regulatory uncertainty: As Aster aims to support RWA stock perpetuals and derivatives, evolving regulation in different jurisdictions may impact its rollout and usage.

What to Watch Next

- Public testnet release (target end-2025) for “Shield Mode,” TWAP and RWA features — first real test of infrastructure performance.

- Mainnet launch date confirmation — as soon as Q1 2026.

- Staking & governance rollout — user participation and on-chain governance proposals will indicate how decentralized and community-oriented Aster becomes.

- Listings & exchange integrations — whether Aster’s chain-based model gets adopted by wallets, exchanges, and institutional partners.

- Token unlock/calendar updates — any further changes to unlock schedules, to gauge long-term supply pressure and tokenomics stability.

Bottom line: Aster’s newly published 2026 H1 roadmap outlines an ambitious transition — from a hybrid DEX to a full-fledged Layer 1 blockchain with staking, governance and advanced trading tools. If delivered, the upgrade could set Aster apart by delivering CEX-like performance with DeFi-style self-custody and privacy. But success hinges on execution, adoption and navigating broader market and regulatory headwinds.