Federal prosecutors in Manhattan asked the court to limit policy-style arguments in the landmark trial of two brothers accused of a $25 million Ethereum MEV (maximal extractable value) exploit, arguing that broad rules about how blockchain markets should work are questions for Congress and regulators — not for a criminal jury to decide. The move comes as defense teams and outside groups try to frame the case as a dispute about acceptable market mechanics rather than alleged fraud.

The case in brief

Brothers Anton and James Peraire-Bueno, both MIT graduates, face federal charges including conspiracy, wire fraud and money-laundering for allegedly using MEV bots to manipulate transaction ordering on the Ethereum blockchain and extract roughly $25 million in a rapid scheme prosecutors say took place in seconds. The trial — one of the first major criminal tests of MEV trading strategies — has drawn intense industry attention.

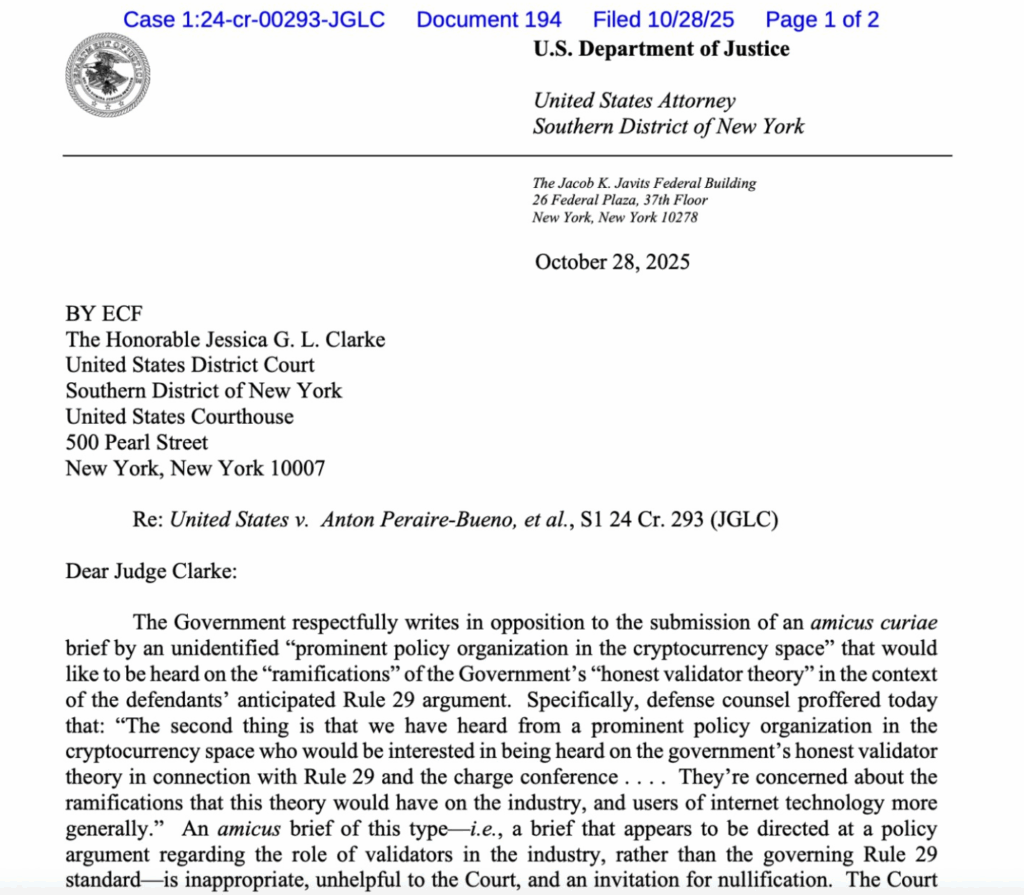

What prosecutors asked the court

Prosecutors moved to block outside policy interventions and to exclude arguments that would ask jurors to resolve high-level contested policy questions about MEV, automated trading bots, or whether certain on-chain behaviours are socially useful or merely novel market mechanics. In filings and in court, the government said such “policy” debates are improper in a criminal fraud trial and warned that inviting them risks confusing jurors and turning courts into ad-hoc rule-makers for nascent crypto markets.

They also objected to at least one amicus submission from tech-policy groups (reports name Coin Center among groups seeking to file briefs), arguing the material would be cumulative and improperly convert the courtroom into a venue for setting industry policy.

Defense strategy and industry reaction

The defense argues the brothers used publicly available on-chain data and that their automated strategies amounted to aggressive but lawful trading — not fraud. Defense teams and several industry commentators say the case raises novel questions about whether exploiting bot behaviour is wrongful7 or simply part of competitive trading in a permissionless market. Some civil-liberties and crypto-policy organisations have sought to submit amicus briefs framing the trial as one with wider market-design implications.

Industry reaction has been mixed: some market-design experts say courts are a blunt instrument for resolving detailed technical policy questions about MEV and ordering games, while others note the criminal law is an appropriate backstop where evidence shows intentional deception and theft.

Why prosecutors’ position matters

- Legal boundaries: If courts allow broad policy arguments in criminal trials, judges and juries could be asked to resolve complex market-design disputes better suited to legislative or regulatory processes. Prosecutors’ stance aims to keep the focus on evidence of intent and deception.

- Precedent for crypto cases: The jury’s decision and how the court handles amicus-style policy briefs could shape future prosecutions of algorithmic or on-chain trading practices.

- Industry clarity vs. criminal enforcement: The case highlights a tension: the crypto industry wants technical norms and policy made via standards, code and regulation — but prosecutors contend clear criminal liability applies where conduct crosses into deception and theft.

What to watch next

- Rulings on amicus briefs and trial scope: Whether the judge allows policy briefs or limits evidence to factual and intent issues will signal how much the court will tolerate broader industry arguments.

- Expert testimony: Expect competing expert witnesses on MEV mechanics, bot behaviour and whether the alleged scheme involved deception beyond sophisticated trading.

- Appeals & doctrinal stakes: A conviction (or acquittal) could be appealed to address the appropriate role of courts in interpreting novel blockchain conduct — potentially producing legal doctrine that guides regulators and market participants.

Bottom line

The Peraire-Bueno trial is more than a high-speed crypto heist prosecution — it’s a test of how U.S. courts will handle technically complex, policy-charged disputes about the mechanics of blockchain markets. By asking judges to confine the trial to evidence of fraud and intent, prosecutors are drawing a bright line: policy debates belong in Congress and regulatory agencies, not at the mercy of individual juries.

MXV5YXFD