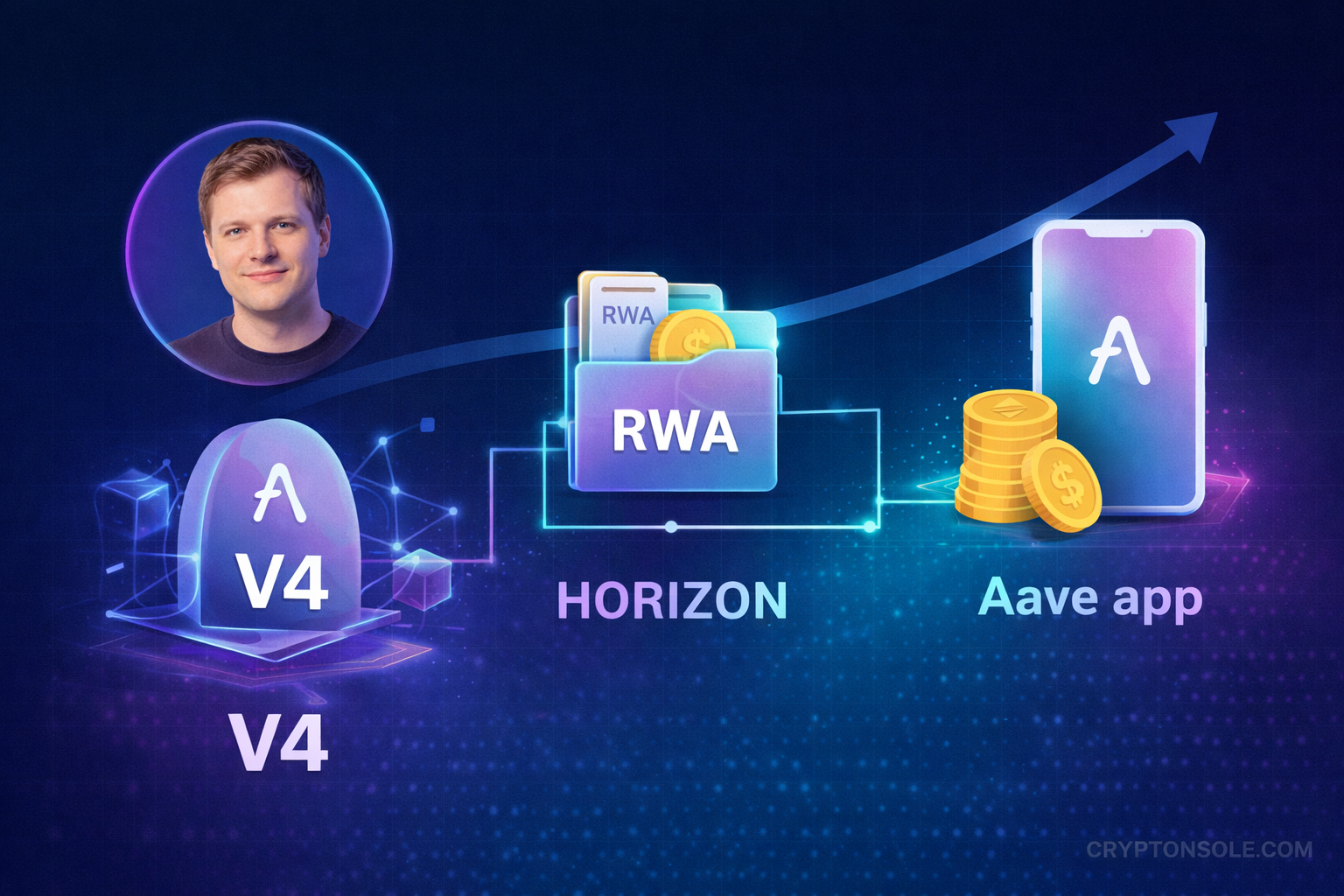

Aave founder and CEO Stani Kulechov has outlined a bold roadmap for 2026, positioning the decentralized finance (DeFi) protocol for broader institutional adoption and mainstream growth. The plan focuses on three pillars: Aave V4, the Horizon institutional RWA market, and the Aave App aimed at retail users — with Kulechov declaring that “Aave will win.”

Vision for 2026: V4, Horizon and Aave App

In a post on X and a recent news release, Kulechov laid out Aave’s strategy for the year ahead, following the conclusion of a lengthy regulatory inquiry by the U.S. Securities and Exchange Commission.

1. Aave V4 — Next-Gen DeFi Engine

At the core of the master plan is Aave V4, a major protocol upgrade expected to serve as “the backbone of all finance,” according to Kulechov. V4 introduces a hub-and-spoke liquidity model that consolidates cross-chain liquidity in a central “hub,” while “spokes” support customizable lending markets — enabling high scalability and tailored markets for specialized assets.

This architecture is designed to handle massive scale, with the potential to support trillions of dollars in assets and attract institutions, fintechs, and enterprise users seeking deep, reliable liquidity onchain.

2. Horizon — Institutional RWAs and DeFi Integration

The second pillar, Horizon, is Aave’s institutional marketplace for Real-World Assets (RWAs). Initially launched in 2025, Horizon provides a regulated framework where institutions can post tokenized traditional assets as collateral and borrow stablecoins or other digital assets.

Kulechov’s 2026 plan calls for aggressively scaling Horizon’s deposits — targeting $1 billion in net RWA deposits — by expanding partnerships with major institutional players and asset managers.

The Horizon market effectively bridges regulated finance with DeFi’s permissionless capital markets, enabling compliant institutional access without sacrificing DeFi’s composability and liquidity.

3. Aave App — Mainstream DeFi Experience

The third pillar is the Aave App, a consumer-focused product recently launched on mobile platforms. Viewed by Kulechov as a “trojan horse” for DeFi adoption, the Aave App aims to tap into the $2 trillion mobile fintech market by simplifying access to decentralized borrowing and lending for retail users.

The full rollout of the Aave App in early 2026 is expected to expand the user base significantly and fuel broader protocol growth by lowering barriers to participation.

Broader Context and Market Impact

Kulechov’s roadmap comes at a pivotal moment for Aave and the broader DeFi sector. The SEC formally concluded its four-year investigation into Aave without enforcement action, which Kulechov framed as a major milestone that clears regulatory uncertainties and paves the way for future innovation.

Analysts say the combination of institutional-grade markets (via Horizon), architectural upgrades (V4), and a consumer-friendly app could help Aave capture both institutional capital and retail engagement — a dual strategy that many DeFi projects struggle to execute.

What’s Next for Aave

- V4 Deployment: While components of V4 are expected to roll out in stages, widespread adoption by developers and integrators will be key to realizing its hub-and-spoke vision.

- Institutional Partnerships: Expansion of Horizon’s institutional roster and RWA integrations will test Aave’s ability to attract regulated capital at scale.

- Aave App Adoption: Usage metrics and user acquisition will be important indicators of DeFi’s mainstream uptake.

- Community and Governance: As a DAO-centric project, governance participation and community alignment will play a role in approving and refining these strategic initiatives.

Bottom line: With Aave V4 promising next-generation liquidity architecture, Horizon targeting institutional real-world asset integration, and the Aave App driving retail adoption, Aave’s 2026 master plan charts an ambitious growth trajectory that seeks to position the protocol as a foundational layer for both DeFi and traditional finance convergence.