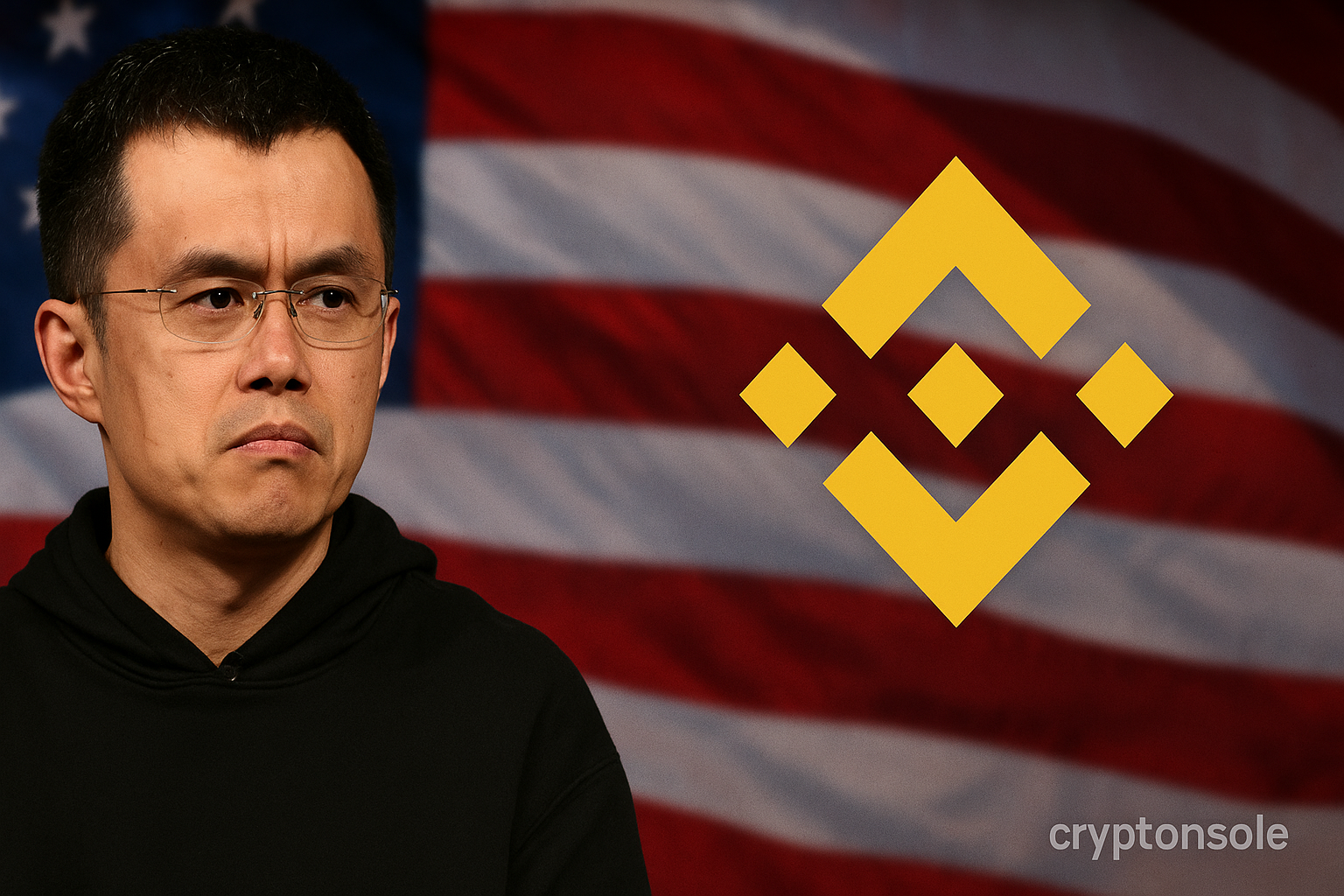

President Donald Trump’s pardon of Binance founder Changpeng “CZ” Zhao on Oct. 23 removes the federal criminal conviction that followed Binance’s 2023 settlement — a development that market participants and lawyers say could make it easier for the Justice Department (DOJ) to end the three-year independent monitorship that was part of that deal. But separate U.S. Treasury Department oversight tied to FinCEN/OFAC settlements remains a distinct requirement and will not be swept away by the presidential pardon.

What the pardon does — and doesn’t

A presidential pardon erases a federal conviction and related criminal penalties, but it does not automatically nullify civil obligations, administrative consent orders, or independent compliance monitors that agencies such as FinCEN or OFAC imposed8 as part of separate Treasury settlements. Analysts and reporting say the DOJ could be more inclined to negotiate an early end to its court-appointed monitor now that the underlying conviction has been pardoned — but any change to the Treasury’s monitorship requires action by Treasury authorities under the terms of those settlements.

Legal experts note the distinction between (a) a criminal plea and DOJ-imposed monitorship tied to that plea and (b) separate civil or administrative settlements with Treasury agencies. The DOJ’s monitorship arose from the 2023 plea and related settlement; Treasury’s oversight comes from FinCEN/OFAC enforcement actions that imposed their own monitoring and reporting obligations. Those Treasury consent orders remain independently enforceable.

Reporting and the negotiation backdrop

Reporting earlier this year showed DOJ prosecutors were already in talks with Binance about whether to relax or end the three-year DOJ monitorship under certain conditions — part of a wider reassessment of monitorships in corporate enforcement. Bloomberg and other outlets said DOJ had in recent months ended or reconsidered monitorships in other corporate cases, and that the Binance monitor was the subject of negotiations. The pardon could remove an obstacle (the criminal conviction) that made an early termination politically or legally simpler for DOJ negotiators.

At the same time, Treasury Department settlements (including FinCEN and OFAC consent orders) independently required Binance to retain external monitors to review sanctions and anti-money-laundering programs; those monitorships were arranged as part of Treasury’s separate enforcement actions and would need Treasury action to alter.

Political and congressional fallout

The pardon has drawn swift criticism from some Democrats and consumer-protection advocates who argue it risks undermining enforcement and accountability. Members of Congress have already pressed the DOJ and Treasury for transparency about contacts between the administration and Binance, and whether any coordination occurred around oversight decisions. In May, senators had formally sought documents and answers about pardon requests and any discussions involving Binance and the administration.

Critics warn that an early end to DOJ monitoring would reduce independent, court-supervised scrutiny of Binance’s compliance program; supporters of the pardon argue it removes what they call an overhang on U.S. innovation and investment. Either way, a split between DOJ and Treasury approaches — where one agency eases oversight while the other continues monitoring — would create a complex compliance environment for the exchange.

What to watch next

- DOJ announcements: Will prosecutors formally move to terminate or renegotiate the court-appointed monitor? Any filings or court notices will be public and dispositive.

- Treasury action or statement: FinCEN/OFAC controls were imposed6 under separate settlements; Treasury statements or filings would be required to modify or end those monitorships. Watch Treasury press releases and consent-order records.

- Congressional oversight: Expect follow-up letters, hearings or requests for documents from House and Senate committees seeking details of any White House contacts or policy discussions involving Binance.

- Market and industry impact: Investors and counterparties will monitor whether a change in oversight affects Binance’s ability to resume or expand U.S. operations, listings or partnerships. Crypto markets have historically reacted quickly to enforcement and policy developments.

Bottom line

The presidential pardon for Changpeng Zhao removes the criminal conviction that underpinned part of the U.S. enforcement posture toward Binance and could make it pragmatically easier for DOJ to end its court-appointed monitorship early. However, Treasury’s separate monitoring obligations — created through FinCEN and OFAC settlements — remain independent legal commitments and will not be automatically eliminated by a pardon; any change to those programs would require action within the Treasury Department’s enforcement framework. The situation remains fluid and will likely play out through agency notices, court filings and congressional oversight in the coming days and weeks.

2CKYFTZU