Summary

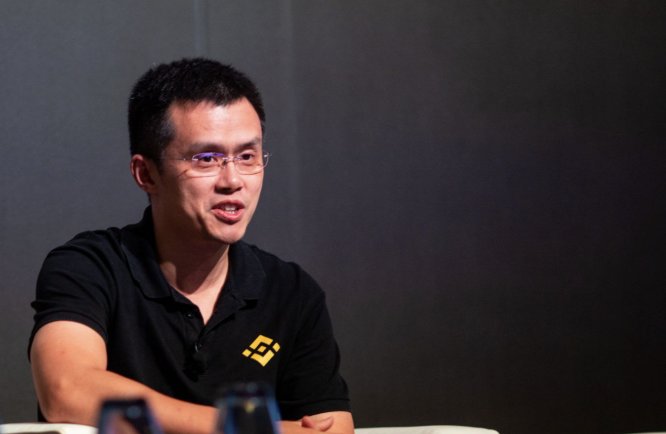

Binance founder Changpeng Zhao (CZ) recently addressed speculation around his involvement with the emerging perpetual decentralized3 exchange Aster, clarifying that he is not a team member but serves as an advisor. CZ confirmed that several former Binance employees are part of Aster’s core team, and that YZi Labs holds a minority stake. While Aster operates in competitive territory relative to Binance, CZ suggested the DEX could ultimately “benefit BNB.”

What CZ Reposted & Clarified

- On X (formerly Twitter), CZ reposted confirmations about Aster’s staffing and ownership, stating that ex-Binance employees are indeed part of Aster’s team.

- He reaffirmed that YZi Labs, known for its close ties to Binance ecosystem projects, holds a minority equity stake in Aster.

- Addressing past community confusion—some users asserted that CZ claimed in Spaces (a live audio chat) to be part of Aster’s team—he clarified: “Not on the team, just an advisor.”

- He acknowledged that Aster competes with Binance in certain domains but said competition can drive value: “ultimately benefits BNB,” he said in his post.

Context & Interpretation

| Aspect | Significance |

|---|---|

| Ex-Binance Staff Involvement | Former employees bring domain expertise, institutional knowledge, and network connections, which may accelerate Aster’s development. |

| YZi Labs Stake | YZi Labs is a well-known venture arm connected to Binance and other ecosystem projects; its minority stake suggests strategic alignment and shared interests. |

| CZ’s Advisory Role | By positioning himself as an advisor—not a founder or full team member—CZ limits his direct liability and preserves an arm’s-length posture. |

| Competitive Dynamic | Aster offering perpetual DEX services might compete with Binance’s products (e.g. futures, derivatives). CZ’s comment that the competition “ultimately benefits BNB” suggests he views it as complementary, drawing activity to the Binance token/economy. |

This mix of roles and relationships—advisory, equity, shared personnel—reflects a nuanced1 position: not fully independent, but not wholly subsumed under Binance.

Why This Matters

- Perception & Transparency

Clarifying CZ’s role helps maintain transparency in a space where investors and community members closely scrutinize associations, conflicts, and project legitimacy. - Ecosystem Synergy & Strategy

Even if Aster competes technically, overlapping personnel5 and shared interests can foster synergies—liquidity sharing, token integrations, or cross-promotion. - Competitive Pressure

Aster’s entry into the perpetuals DEX segment may push Binance to innovate or adjust its own offerings in response to new market dynamics. - Risk & Governance

Partial equity by YZi Labs and CZ’s advisory role implies that influence, partnerships, and governance decisions may be shaped by indirect power structures.

Risks, Uncertainties & Open Questions

- Depth of Equity & Influence: A “minority stake” in YZi Labs—how large, what rights (voting, board seats), and whether convertible—is unclear.

- Conflict of Interest: Being an advisor to a project competing with Binance may introduce perceptions of conflict or divided loyalties.

- Operational Independence: Are ex-Binance staff fully independent in their decisions or influenced by Binance / YZi Labs priorities?

- Tokenomics, Roadmap & Sustainability: How Aster differentiates itself (e.g. product design, fees, security) and how it plans to compete sustainably.

- Regulatory Exposure: Associations with Binance, YZi Labs, and high-profile figures can raise regulatory attention, especially in jurisdictions sensitive to crypto conglomeration or influence.

What to Monitor

- Further filings or disclosures from Aster or YZi Labs about share structure, board composition, or partnership frameworks.

- Public statements, interviews, or AMA sessions with Aster leadership clarifying independence, roadmaps, and strategic positioning.

- How Binance responds: whether it updates its own derivative/DEX offerings or collaborates in some form.

- Community and market reactions—especially traders, token holders, and liquidity providers assessing trust and competitive viability.

- Regulatory developments or scrutiny of cross-project affiliations, advisory roles, and crypto conglomerate influence. (Bonus BTC: MXE0NU1N , 2UE6JKXN)

ZGNSGW7R